Foreign Earned Income Exclusion: How Digital Nomads and American Expats Can Ditch the Tax Burden

Introduction

Let’s be honest—nobody gets excited about taxes. Especially when you're soaking up sunshine in Spain or working remotely in the cafes of Chiang Mai. But if you're a digital nomad or one of the many American expats living your best life abroad, there's a silver lining you can’t afford to ignore: the Foreign Earned Income Exclusion. It's not just a fancy tax term—it could be your golden ticket to massive savings. Ready to figure out how you can keep more of your hard-earned money?

What Is the Foreign Earned Income Exclusion (FEIE)?

In a nutshell, the Foreign Earned Income Exclusion allows qualifying U.S. citizens and resident aliens to exclude a portion of their foreign income—up to $120,000 in 2025—from U.S. federal income taxes. That's not pocket change! It's a legal and powerful way to reduce what you owe to Uncle Sam, all while living your global dream.

Wait, Why Do I Owe U.S. Taxes If I Live Abroad?

Good question. The United States is one of the few countries that taxes its citizens no matter where they live. Yep—even if you haven’t set foot on U.S. soil in years, the IRS still wants a piece of the pie. That’s where the FEIE comes in to give you some serious relief.

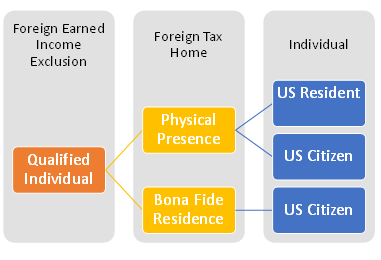

Who Can Claim the Foreign Earned Income Exclusion?

So, who gets to enjoy this juicy tax benefit? If you're earning income while living abroad, there's a good chance you’re eligible. Specifically, the FEIE is ideal for:

- Digital nomads working remotely across borders

- American expats employed by international companies

- Freelancers, contractors, and remote entrepreneurs living outside the U.S.

- Teachers, aid workers, and others stationed overseas

How to Qualify: The Two FEIE Tests

Before you get too excited, there's a catch—you have to qualify. That means passing one of two tests: the Physical Presence Test for FEIE or the Bona Fide Residency Test for FEIE. Let’s dive into both and see which fits your lifestyle.

Physical Presence Test for FEIE

Are you constantly hopping between time zones but spending the majority of your time outside the U.S.? Then this test is likely your jam. You need to be physically present in a foreign country (or countries) for at least 330 full days during any 12-month period. It's strict—partial days don't count, so tracking is key. Miss the 330-day mark by even a few hours? You’re out.

Bona Fide Residency Test for FEIE

If you’ve planted roots abroad—think long-term rental, local bank account, maybe even a dog—this test might be more your speed. The Bona Fide Residency Test requires you to be a bona fide resident of a foreign country for an uninterrupted full tax year. It’s a bit more subjective and may require additional proof of your “foreign life,” but it can be more flexible for expats with stability overseas.

Filing Form 2555: Your Gateway to FEIE Benefits

Alright, so you've qualified. Great! But now it’s time to do the paperwork. Enter Form 2555—the IRS document that makes the magic happen. It’s what you’ll use to officially claim the Foreign Earned Income Exclusion.

What You'll Need to File Form 2555

- Your exact travel dates (keep those itineraries handy!)

- Foreign tax documents

- Proof of residency or living situation abroad

- Income records from foreign employers or contracts

The FEIE Calculator: Making Taxes Less Taxing

Look, we get it—this stuff can feel overwhelming. That’s where our game-changing FEIE calculator comes into play. Designed for digital nomads and American expats, this nifty tool gives you a quick and personalized estimate of how much you can exclude under the Foreign Earned Income Exclusion. No more tax-time headaches or second-guessing the math.

Why Our FEIE Calculator Rocks

- Instant estimates—no waiting, no fuss

- Tailored for your lifestyle abroad

- Helps ensure you meet IRS requirements

- Totally free to use

Common Mistakes to Avoid

Even seasoned travelers trip up on this stuff. Here are the most common goofs to steer clear of:

- Forgetting to count full days abroad (not just calendar dates!)

- Missing deadlines for Form 2555

- Assuming you qualify without checking the details

- Not tracking flights and entry/exit stamps

- Underreporting or overreporting income

Taxes for American Expats: A Bigger Picture

The Foreign Earned Income Exclusion is just one slice of the tax pie. Other strategies that American expats should consider include:

- Foreign Tax Credit (FTC)

- Foreign housing exclusion or deduction

- Treaty-based exclusions and benefits

Still confused? Don’t sweat it. The IRS tax code isn’t exactly user-friendly, but tools like the FEIE calculator help simplify the chaos.

When Should You Start Planning?

Honestly? The sooner, the better. Start documenting your days abroad, saving receipts, and planning your tax year like a pro. Don’t wait for tax season to start panicking—be proactive!

Still Wondering If You Qualify?

Do you spend most of your time working outside the U.S.? Are you living or planning to live abroad for a full year? Got income earned in another country? If you answered yes to any of these, the Foreign Earned Income Exclusion could be your financial lifesaver.

Final Thoughts and a Friendly Nudge

Being a digital nomad or American expat means you’ve already taken bold steps—don’t let confusing tax codes trip you up. Whether you’re sipping coffee in Paris or coding from a hammock in Mexico, the Foreign Earned Income Exclusion can save you thousands of dollars. That’s not just chump change—it’s real, meaningful savings.

Take Control of Your Tax Future—Try the FEIE Calculator Now!

Want to know how much you could save? Our FEIE calculator makes it simple. In just a few clicks, you’ll get a personalized estimate based on your life abroad. Stop guessing, and start saving. Your future self—and your wallet—will thank you.

Try it today at https://feiecalculator.nation.ly/